Is the GameStop Saga a Warning?

Social media has given retail investors a better chance to win on Wall Street, but at higher risk.

Image: Kotaku

GameStop, Reddit, Robinhood, short squeeze, Wall Street.

If you’re wondering how these things are related, you’re not alone. For the last couple of weeks, a trading tussle between hedge funds on Wall Street and an organized group of individual investors has ignited controversy over the yo-yoing stock price of GameStop, a video game retailer.

Wall Street giants like Melvin Capital had been betting since early last year that GameStop, a brick-and-mortar business in a rapidly digitizing industry, was going to go bankrupt. So, they took what’s called a “short” position in which they expected to profit off of GameStop’s falling stock price. By January, however, a large group of individuals and retail investors had banded together on the internet to buy GameStop stock (GME). The share price exploded in what’s called a “short squeeze,” causing some on Wall Street to lose billions.

[Look here for an overview]

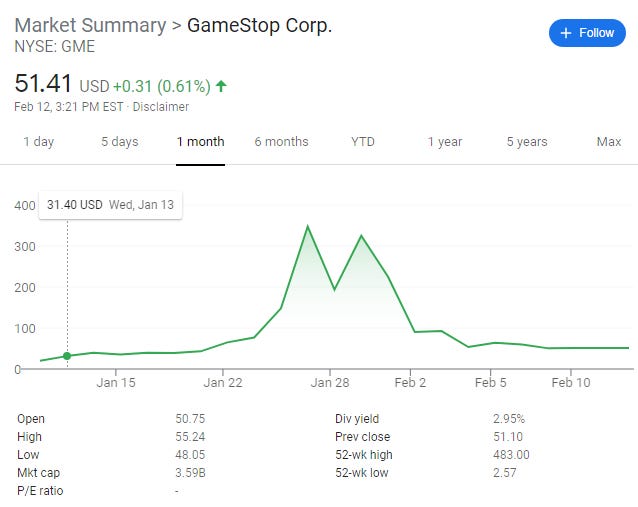

The stock price jumped from $19.94 on Jan. 11, 2021, to a near stratospheric (for GameStop) $347.51 on Jan. 27. GME’s price came crashing down after trading apps like Robinhood stopped users from buying the stock. It closed at $51.10 on Feb. 11 and the U.S. Securities and Exchange Commission is currently conducting an investigation into the price swings.

Image: Google screen capture, Feb. 2, 2021 (GME 1 months price variation)

But now that the dust has settled, it’s worth asking what the GameStop saga tells us about the overlap between social media and the stock market.

“Reddit rebellion”

With GME’s price skyrocketing, mainstream media outlets began running with a story of rebellion. The narrative focused on how individual traders banded together on WallStreetBets – a Reddit forum that is described as “like 4chan found a bloomberg terminal [sic]” – to teach Wall Street a lesson.

For instance, CNBC’s Jim Kramer, the host of Mad Money, noted on Jan. 14 that forums like WallStreetBets were “populated by mostly younger members and participants who are plainly, openly plotting to blow up the shorts, in this case by buying GameStop at any price.”

Part of this story is true. For instance, Melvin Capital, one of Wall Street’s largest hedge funds, posted losses of 53% in January due to its short position in GME. By contrast, many individual investors won big, with some cashing out to buy a house, pay off a student loan, or pay medical bills.

But the “Reddit rebellion” story misses how some of Wall Street’s biggest funds – including those who owned shares beforehand and those that bought and quickly sold GME – made money off the rising stock price. As a piece for The Washington Post reported on Feb. 8, Wall Street firms – or employees – might themselves have used Reddit to inflate the price of GME to harm competitors and benefit their own portfolios.

Wall Street is exceedingly good at making money and it would be naïve to say that some large institutions and funds didn’t benefit from the GameStop surge. Nevertheless, it’s one dimensional to suggest that what happened in January was business as usual. Instead, what came out of the GameStop saga is how social media has given investors the possibility to quickly and effectively turn the market on its head.

In other words, social media is likely to alter the market’s landscape, not so much by levelling the playing field between Wall Street and the rest (as the Reddit rebellion narrative claims) but by introducing populist organization as a tactic that both institutional and retail investors can use to bet against competitors or/and make quick cash.

“They don’t have an edge”

Even if the Reddit rebellion was - to some extent - driven by Wall Street, the GameStop saga also shows us how social media has introduced finance to a wider audience. What’s interesting is that not all retail investors are looking to make a quick buck off an unpredictable stock market trend. For instance, despite GME’s falling price, many on WallStreetBets continue to think businesses shorted by large hedge funds, such as GameStop, AMC, Blackberry, and Nokia, are good investments because they are likely to succeed in the long term. In other words, these investors are betting that Wall Street is wrong about the economy.

[There are] a lot of people doing some incredible fundamental research on companies, trying to think about long-term value, and in my opinion many of them are doing as good and frankly a better job than the hedge fund analysts I work with…

This was CEO Chamath Palihapitiya assessment of WallStreetBets in an interview with CNBC. “They don’t have an edge,” he went on to say, referring to institutional investors.

There is plenty of financial information on social media. For example, in my Reddit research for this piece, I came across a thread labelled, in part, “Why I’m holding 1500+ shares of AMC and am not selling.” The original post by a user called theangrycoder 22, while not terribly popular, was a detailed analysis of why the cinema industry would not only survive the pandemic, but bounce back once lockdown restrictions ended. The post referenced, among other things, how AMC had avoided bankruptcy by raising capital in the last year, the COVID-19 vaccine rollout and its effect on future cinema openings, Hollywood’s reliance on movie theaters, AMC’s distinct business model within the industry, and a rise in trading flows demonstrating long-term interest in the stock. In short, this post, and many others talking about stocks like Nokia and GameStop, rejected the conventional wisdom on Wall Street that these businesses would go under at some point in the future.

This means that forums like WallStreetBets are not just about fomenting reactionary trading strategies against larger, much more established institutional investors. Instead, social media in general has become instrumental in spreading the kind of information that people need in order to make well-informed investments. That information may be right or wrong, but social media has expanded access to it beyond Wall Street, where “idea dinners” tend to keep discussions about stock valuation out of reach for most individual investors. In this sense, the GameStop saga may pose a different question: what happens when the little guy has a chance on Wall Street?

“One less chair when the music stops”

Unfortunately, the answer to that question is going to have to wait until the market gets a clearer picture about whether the COVID-19 vaccine rollout will bring the pandemic under control, and relatively soon.

And this is the larger point. The GameStop saga might be a warning about the uncertain state of the U.S. economy. The stock market’s runaway success in the last year has some analysts worried that prices don’t reflect what’s happening in the real world. In economist terms, that means the possibility of a bubble. In non-economist terms, it means that stock prices are speculative in that they don’t reflect how businesses are doing, or what their underlying value may be. The fact that stock prices are at an historic high at a time when businesses are closing and Americans are unemployed, facing eviction, and relying on stimulus payments means there is a yawning gap between prices and the economy.

“When confidence has reached these levels, the history books are pretty clear: it’s very difficult to increase your enthusiasm from a state of mild hysteria,” said famed investor Jeremy Grantham, in an interview with Bloomberg’s Erik Schatzker.

“Everybody knows there’s going to be one less chair when the music stops,” said American billionaire Sam Zell in an interview with CNBC. “And they’re betting they can get out before somebody else gets out.”

Image: Google screen capture, Feb. 2, 2021 (Dow Jones Industrial Average max timeline)

And that’s the real warning in the GameStop saga. While social media can help retail investors organize and share information, it cannot insulate them from a stock market crash which will likely hurt smaller investors far more than institutional ones.

In the end, the much lauded social media-led “democratization of finance” might just mean that more people have access to a casino – one in which a majority is expected to lose against the house.

If you enjoyed this post, why not subscribe to The Quotient for more independent journalism, commentary, and analysis on issues of public interest?

Article recommendation for the week:

“Superstar Cities are in Trouble” - The Atlantic, Feb. 1, 2021

An earlier edition of this newsletter argued that cities are likely to survive the pandemic and thrive when the new normal arrives. This article takes an excellently nuanced look at that assertion.